5 Ways I Invested In My Health, Wealth And Happiness In One Week

The last few years have felt like a whirlwind. When I look back the path is made up of a stack of stepping stones in wildly varying hues that represent unexpected changes, short-term solutions and some significant financial stressors that coloured my journey. As 2022 tapers towards slower days I want to take the opportunity to learn from these fluctuations and turn my attention towards what’s next—to start properly investing in some long-term goals.

Taking inspo from Syfe, an investing app that champions the commitment to long-term growth and investing for the future, not just short-term payoffs, I decided to spend a week investing in my own health, wealth and happiness to set me up for ongoing success.

Read on to find out how pilates, Friday margies and the Nasdaq all featured in my week of self-investment.

Monday: Getting Off On The Right Foot

Monday was a tick in the ‘Health’ category. When I tell you that I used to be a barista, five days a week, for about eight years of my life, you might assume that I’m a morning person—I am not. The thing is, I know for a fact that I function better and my mindset is healthier when I get up and move my body in the morning. So, Monday was all about making a commitment to invest in my health by waking up when my alarm actually goes off and getting out for a walk before work.

I expected to feel accomplished and awake by the time I made it back home, but I also discovered a stack of other knock-on effects. I’d not only woken up my brain but my metabolism too. Trading the usual coffee at my desk first thing in the morning for some actual cereal before 9am did wonders for my concentration and energy.

Tuesday: Taking The Investing Inspo Literally

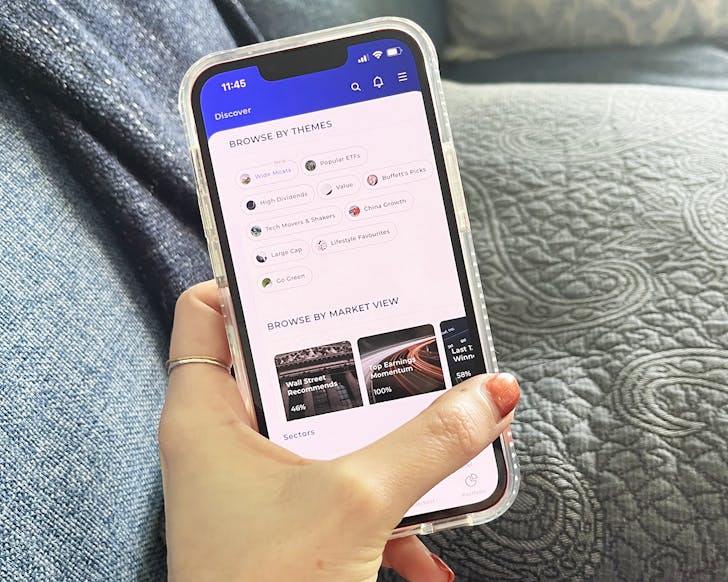

Okay, time for Literal Tuesday. I couldn’t spend a week investing in my future without thinking about my finances. Outside of my high-interest savings accounts and my superannuation, I’ve never really dived into the world of wealth-growing. I have savings down pat though, which gives me the confidence to take the same slow and consistent approach as I dip my toes into investing. So, I made a cheeky instant coffee to sip in the sun before work (after my morning walk, hello consistency) and downloaded the Syfe app.

The first thing I noticed was how secure it felt. With two-factor authentication to log in, it feels on par with the banking apps I already use. When I first opened the app, I was at the short, tentative sips stage of my hot coffee. By the time I’d made it to the bottom of the cup, my account was fully set up, after plugging in some standard identity verification and account details. Never one to dive right in without doing a bit of research first, I noodled around on the interface for a bit and then checked out the in-app blog—it's stacked with 101 investing guides and other helpful content.

Feeling empowered from this research, I check out the Wall Street insights, which is basically a summary of where the world’s top bankers think your fave brands (and the stocks behind them), will head next. After wrapping my head around that, I had a little exploration of the Nasdaq and S&P 500 before putting some money where my mind was. The app has this easy, Google-style discovery feature which I used to find a couple of stocks that ticked my sustainable practices box as well as indicated a ‘buy’ recommendation from the app’s analysis. I invested the same amount that I would spend going out to breakfast with my mates. Slow and steady—I’ll check back soon to see what’s happening with my dollars and grow my confidence from there.

Wednesday: Connecting With The Fam

Today we’re putting a tick in the happiness box and spending some time with mum and dad always fills my tank and gives me perspective on any woes. I’m in Sydney, and my parents are back in my hometown, Brisbane, so a video call is the next best thing to an actual hug and a chat on their balcony over a glass of wine (a chilled pinot noir for Dad and a low-alcohol pinot grigio for me and mum—a couple of ice cubes if it’s particularly humid). With wistful thoughts of the balcony, I pour myself a glass of bubbly water and set myself up on the couch. I can already feel my happiness metre tick up dramatically as soon as Mum’s bespectacled face fills the screen on my phone. An hour later my tank is at full capacity, again.

Thursday: Investing In Bone Density

Alongside waking up at 6am every morning, another thing I used to be good at was going to pilates regularly, but I’ve fallen out of rhythm recently. Speaking to Mum on Wednesday night, she mentioned she’s been going to pilates to work on her bone density as osteoporosis runs in the family. That was all the motivation I needed to get me back on the tools—after all, this week is all about looking into better investments for my future, and these bones are the only ones I've got.

I book in for a 7am class and arrive a little early so I busy myself with flicking through the Syfe in-app news function to keep the newfound investment and research gears in my brain spinning. As class begins I’m reminded I'm out of practice and that my muscles will be sore tomorrow, but I feel happy knowing that the time spent now will pay off tenfold for my bone health in the future. Plus, knowing that I'm taking steps to understand investing and do money better, I'll have some extra space in my budget for weekly pilates classes, which is a big win.

Friday: Dropping Some Coin At Dinner Is An Investment

There’s really no better way to celebrate the end of the week than rallying your mates, nabbing a booth table at your local Italian restaurant and cheersing to your friendship with a round of margaritas. This was how I put another tick in the happiness box for my week—one that really showed how long-term investing pays off in spades. I've known these friends for over a decade now we've always championed each other's successes. One of the things we've been championing more and more lately is how much better we've all become with our money. As we go to split the bill at the end of dinner, I notice that the weekly, set-and-forget-style reoccurring investing option I activated with Syfe on Tuesday has taken a small, nominated amount out of my account. I can't help but brag to my mates that while we were snacking on scallops and stracciatella, I was growing my wealth, hands-free. A great feeling to round out the week investing in and feeling more in control of my health, wealth and happiness.

Keen to kickstart your own long-term investment journey? Head over here to download Syfe.

Editor’s note: This article is sponsored by Syfe and proudly endorsed by Urban List. All content above is general advice, please speak to a financial expert when seeking specific financial advice. Thank you for supporting the sponsors who make Urban List possible. Click here for more information on our editorial policy.

Image credit: Urban List